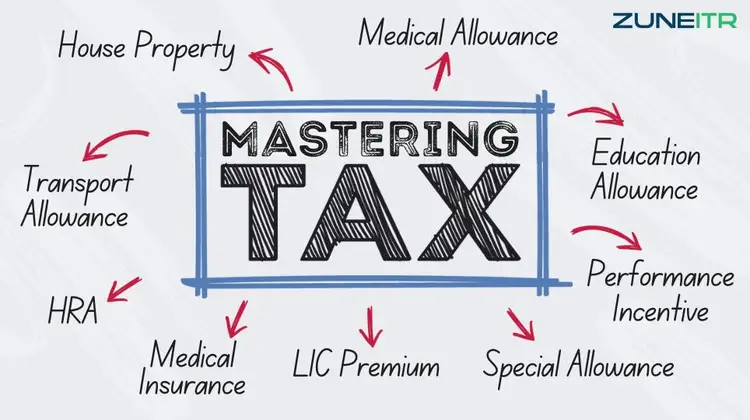

Stop Overpaying Your Taxes!

Unlock Hidden Deductions & Maximise Your Benefits

ITR Filling for

The 'Standard Deduction' May Not Be Your Best Option

Not Using O2M Tax Expertise Means

Confusion over complex tax terminology and ever-changing rules

Not claiming all the deductions you’re entitled to

Frustration due to the time and effort spent trying to figure out your taxes

Working with ZuneITR is Easy

1 Book an Appointment

Secure your spot for a personalized tax consultation with ZuneITR.

2 Discuss with our O2M Tax Expert

Get personalized tax advice from our knowledgeable O2M Tax Expert.

3 Enjoy your Tax Benefits for Maximum Gains

Experience the power of maximizing your tax benefits for ultimate financial growth with ZuneITR.

What’s it like having an O2M tax expert with you?

Maximize their take-home pay with your expert tax optimization

What our clients say

Why ZuneITR?

Initial Questions

Saves your time, streamlines the assessment process, and allows focus on deeper topics during consultations.

Expert Identification

Applies complex tax code knowledge most individuals lack, maximizing potential deductions and benefits

Clear Calculations

Demonstrates the tangible value of O2M’s approach, motivating your action.

Holistic Tax View

Considers all aspects of your income and expenses for deduction opportunities often overlooked

Personalized Options for Your Tax Returns

Choose from a Range of Tailored Packages for Hassle-Free Tax Returns

Working Professional

₹4,000

₹2,000

Business Owner

₹6,000

Download your Free copy of

Tax Return Essentials Checklist

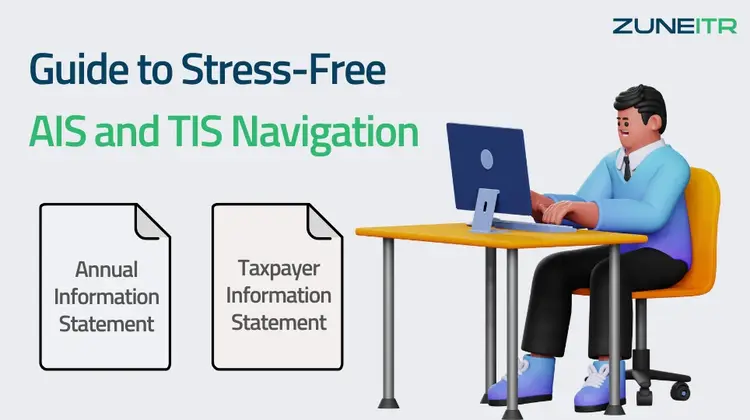

Our Blog

FAQs About Individual Income Tax Returns

Is it necessary to link Aadhaar with PAN to file ITR?

Yes, it is necessary to link the Aadhaar with PAN. In case of failure to do so, PAN will be deemed as inoperative and there will be several implications such as:

- The taxpayer shall not be able to file an Income Tax return using the inoperative PAN

- Pending returns will not be processed by the Income Tax Department

- CBDT will not issue refunds due to inoperative PANs

- CBDT also clarified that the Pending proceedings as in the case of defective returns cannot be completed once the PAN is inoperative

- Income Tax will be required to be deducted at a higher rate as PAN becomes inoperative

I am a joint owner of a house with my spouse. We do not have any additional property. Can I file ITR-1 in AY 2024-25?

Yes, you can file ITR-1 for the AY 2024-25 in case the following conditions are met

- If you are a single or joint owner of a single property, you can file ITR-1 for A.Y 2024-25

- If you own more than one property, you can’t file ITR-1 (even as a single owner)

I made a calculation mistake in my filed ITR. Can I correct it and re-submit my return?

Yes, you can re-submit your return in case you have already filed your Income Tax Return but you later discover that you have made a mistake. This is called a Revised Return. Your return has to be revised three months before the end of the relevant AY. For AY 2024-25, the due date for filing revised return is 31st December 2024.

What happens if I file Income Tax Return after the due date u/s 139(1)?

In case you miss filing the ITR within the due date u/s 139(1), you can still file your Income Tax Return, but you may be required to pay a late filing fee of up to ₹5,000/-. Additionally, you will also be required to pay interest on the tax liability (if any).

Do I need to file returns if tax has been deducted by my employer / bank?

Yes, employers and banks deduct tax at source on salary and interest income respectively. You still need to disclose the income on which tax has been deducted and to claim credit for TDS in the Income Tax Return.

Will I get a refund if I have paid excess tax?

Yes, any excess tax paid by you can be claimed as refund by filing your Income Tax Return. After your return is processed, ITD checks and accordingly accepts your refund claim, and then the amount is credited to your verified bank account. You will also get a message on your email ID registered on the e-Filing portal.

I am an individual having business income; can I opt for new tax regime while filing ITR-4?

Yes, you can opt for new tax regime. If you have business income but for opting new tax regime, you have to file Form 10IE before filling the ITR.

I am an individual having business income. Can I switch between old tax regime and new tax regime every year?

Individuals having business income are not eligible to choose between the new and old tax regimes every year. Once they have opted for the new tax regime, they only have a one-time option of switching back to the old tax regime. Essentially, people with business income may have to fill out Form 10-IE twice, once to use the new tax regime and the second to switch back to the old regime.

What is the due date of filing form 10 IE for opting/withdrawing new tax regime?

As per the income tax laws, an individual having business income shall submit form 10-IE before the due date of filing ITR i.e. July 31 under non-audit cases and 31st October under audit applicable cases.

The gross receipts for my business in the year are more than ₹ 2 Crore. Can I opt for presumptive taxation scheme of 44AD?

Yes, you can opt for the presumptive taxation scheme of section 44AD provided the gross receipts are upto Rs.3 Cr and the amount received in cash does not exceed the 5% of the total turnover.

I opted for presumptive income scheme of Section 44AD or 44ADA. Can I claim further deduction of expenses after declaring profit at applicable rate under respective sections of gross receipts?

No, a person who opted for the presumptive taxation scheme is deemed to have claimed all deduction of expenses. Any further claim of deduction is not allowed after declaring profit at specified rate. However, you can claim deductions under Chapter VI-A.

I opted for the presumptive income scheme of Section 44ADA. Do I have to pay Advance Tax in respect of income from profession covered in Section 44ADA?

Yes, anyone opting for the presumptive taxation scheme u/s 44ADA is liable to pay 100% of Advance Tax on or before 15th March of the previous year. If you fail to pay the Advance Tax by 15th March of previous year, you will be liable to pay interest as per Section 234B and Section 234C. Any amount paid by way of Advance Tax on or before 31st March will also be treated as Advance Tax paid during the FY ending on that day.

I opted for presumptive taxation scheme of Section 44ADA. Do I need to maintain books of accounts as per Section 44AA?

If you are engaged in a specified profession as referred in Sections 44AA (1) and opt for presumptive taxation scheme of Section 44ADA (declare income @50% of the gross receipts), you are not required to maintain the books of accounts in respect of specified profession (i.e. the provision of Sections 44AA will not apply).

I have filed ITR-1 and opted for new tax regime in earlier years. What shall I select in ‘Have you ever opted for new tax regime u/s 115BAC in earlier years' field?

All the questions of Section 115BAC are to be answered from the perspective of returns filed with business income and select the relevant dropdown, by ignoring the contents of the non-business returns filed, if any in between. Therefore, you may select ‘No’, unless any Circular/ Notification/Amendment says otherwise.

I have filed ITR-4, New Tax regime in FY 2020-21. In FY 2021-22, I have filed ITR-1, Old Tax regime. What are my option available for FY 2022-23?

You had opted for the new tax regime based on the latest business return, so you may continue to be under new tax regime, or you may opt out through filing Form 10IE for a non-business return, unless any Circular/ Notification/Amendment says otherwise.